E-commerce in Hungary: Coronavirus, Changes and Chances

More and more international players are interested in expanding to Hungary. And rightfully so: its e-commerce market still has space for growth, which most likely will continue. It is particularly popular among Czech online retailers. To this day, over 2000 Czech online stores have expanded here, the biggest names included: Alza, Mall, Rohlík (Kilfi.hu), Bonami, Notino, Alensa, 4Home, Kytary and many others. How has coronavirus influenced Hungarian e-commerce, both native players and Czech businesses? Is it still a viable option for expansion? And what are the best practices to thrive here, post-crisis?

Timeline: Three waves of changes in online shopping behavior

On the 11th of March, the Hungarian government declared a state of emergency. However, online sales started rising significantly as early as the 22nd of February. In this first wave, people were buying mostly protective face masks (a 590% demand increase), hand sanitizers (420%), wipes (184%), antiseptic sprays (178%), disposable gloves (151%), vitamins and bottled water (78%), soaps (33%) and toilet paper (26%).

The second wave was a reaction to the government’s first set of restrictions, which was also heavily stirred up by the media. Consumer behavior confirmed a higher demand for cleaning and protective products, and durable food also appeared in most shopping carts. Online retailers in segments such as Food, Baby Care, Hobby, DIY, Garden, Beauty, Smartphones and Accessories, Auto Moto and Consumer Electronics all rose by 11-58%, according to this study conducted on 4000 Hungarian online stores. There was a smaller increase (up to 6%) in the sales of Office Equipment, Beverages, Tobacco and Computer Equipment. On the other hand, Fashion and Clothing, Books, Home Appliances, Sports and Leisure witnessed a slight 5% decline in demand and Gifts, Furniture and Erotica declined by 12-31 %.

In the third wave, the traditional brick-and-mortar shopping experience poured into online space. Restrictions forced by the Hungarian government were similar to the ones in other CEE countries: banning public events for 100 or more people, moving education online, and closing shops and services — a national lockdown.

According to Aruhereso.hu marketplace, its traffic dropped by 2% by the end of March, but “according to our data, some sellers were able to increase sales by 40% using smart tech tools for bidding such as Dataweps Beed,” our Country Manager for Hungary, Ivan Rédey adds. When it comes to concrete segments, Arukereso confirms increased demand for protective and cleaning products. Thermometers were sold 5 times more than usual, and air purifiers 1,5 times. Arukereso users were searching for laptops 70% more than before, and there’s been increased interest in e-learning tools, web cameras and print machines. Gaming consoles witnessed a 90% increase in demand, computer games 25%, board games 20%, and puzzles 70%. There’s been a slight decrease in demand for TVs, smartphones and digital cameras.

A food craze manifested itself by increased demand for durables. Arukereso.hu informs in its press release that, “canned food, pasta, instant noodles, preserves and jams showed 50% higher traffic and flour 4 times higher traffic than usual.” People were buying instant yeast in bulk, too. People were buying twice as much dog food and 40% more cat food as well as more collars, leashes and pet toys.

The products that have made the highest jump in demand on Arukereso.hu were 1) at home fitness, various wrist and ankle weights, leggings and athleisure; 2) dog leashes, cat toys and parrot food; and 3) saxophones and drums for hobby musicians stuck at home.

Keywords such as “Tesco home delivery“ and “Auchan home delivery“ (after Tesco, Auchan is number two in delivering groceries in Hungary) were searched twice as much compared to March 2019. Almost one-fourth of Hungarians are used to ordering groceries online, about 67% of whom prefer Tesco and 27% Auchan.

The Average Order Value increased by 28% in the second wave and 24% in the third wave (reaching 27 161 HUF / 76,94 EUR).

E-commerce players’ responses:

Extreme Digital (eDigital) kept its stores open (which is allowed), shortened its opening hours and limited the number of people allowed one the selling floor at the same time. When it comes to maintenance, most businesses across CEE have installed similar measures, eDigital included: protective clothing for its employees, medical check-ups, and cleaning and sanitizing stores and warehouses several times a day.

From the consumer point of view, eDigital encourages its customers to have the purchase delivered home or claim it via pick-up machine in order to minimize physical contact. Three payment options are encouraged: card payment online, and card or smartphone payment on the spot for collecting an order at a pick-up point. Cash is not promoted, though neither is it explicitly prohibited. The eDigital marketplace also adjusted its delivery service: bigger orders can be packaged into smaller boxes and sent separately so that customers receive (some of) them as soon as possible.

Messengers can allegedly refuse to deliver the package in specific cases when the recipient is a quarantined person, a hospital or other medical facility, or in case they believe the risk of delivering is too high.

Hungarian e-commerce leader eMAG merged with eDigital at the end of last year, so it doesn’t come as a surprise that many of the undertaken measures are similar. eMAG’s employees are provided with protective apparel, thorough medical check-ups are being held on a regular basis, and interiors are being cleaned and sanitized. Customers are encouraged to avoid cash payments. A new seller policy was introduced, eMAG forbids unreasonably high prices (as well as excessive shipping rates) and bans spreading misinformation and misleading advertising.

The price comparison website Arukereso.hu is a place where more than 3500 sellers offer more than 16 million products. Its raison d’etat during the coronavirus outbreak is the same as it’s always been, according to the company’s Marketing Manager László Baka: “We strive to offer a safe digital space for people to find the best deal fast, based on comparing prices and reading customer reviews.” Those who were inspired by our current situation to shop online for the first time (Hungary’s online shopping penetration number is 91%, meaning that nine out of ten citizens shop online at least once a year) can appreciate how straightforward shopping at price comparison sites is, according to Baka. “Other advantages of online shopping are 24/7 availability, cashless payment options and home delivery, so that you literally don’t have to set foot out of your house,” Arukereso’s Managing Director Csaba Rácz states.

Media Markt placed some of the current most on-demand categories on its homepage: household appliances and computer or tablet accessories, among others. The Polish site, however, changed its whole homepage, including hashtags, so that it states loud and clear: We got you covered in times when you need to work remotely in a clean and healthy home. The Media Markt online store reinforces online payment either by card or Paypal. Messengers can’t stand closer than two metres away from the door and customers are encouraged to have their own pens for signing documents. Messengers can decline in rare cases, especially when the recipient has been abroad in the last two weeks or suffers respiratory problems.

A significant number of Tesco‘s range of products (13 000 products) is available for home delivery in bigger cities like Budapest, Debrecen, Nyíregyháza, Hajdúszoboszló, and Hajdúböszörmény. Tesco online shopping only allows card payments up front, and the maximum order size is limited to 80kg per purchase, as of March 30th. Items that are currently unavailable are replaced by alternatives handpicked by Tesco’s staff.

220volt online store offers 20 000 products from segments such as Electronics, Computers, Smartphones, DIY, Housing, and Gardening, while the shop claims that at least half of the portfolio is in stock. A dozen recommended products with free shipping were introduced, mostly necessities for working from home, but also digital cameras and selfie sticks. 220volt encourages customers to shop and pay online, as opposed to visiting showrooms. The aforementioned showrooms in Budapest and Szeged are nevertheless open, with shorter opening hours, and the number of people allowed in the same room is limited to two.

MALL, a Czech marketplace operating successfully on the Hungarian market, highlights in-demand products on its website: fitness equipment, outdoor trampolines, pet food, cleaning and sanitizing products, home appliances, and home office supplies. Mall’s blog discusses relevant topics such as boosting one’s immune system, spring cleaning, home makeovers, and DIY barista coffee.

ALZA added another category to its catalogue – protective items (like face masks, sanitizers, thermometers, and gloves) and adopted measures against unreasonably high prices. Both employees and messengers undergo medical check-ups and other preventative measures. Showrooms remain open, but once 3PM hits, it can only sell orders from a short list of segments (groceries, parfums, drugstore goods, home cleansers, and hygiene products). The company’s mascot has begun sporting a face mask, and other marketing activities were taken to respond to the current situation’s development, including Instagram contents for the most stylish home office.

A grocery delivery service in Budapest and its surroundings, Kifli.hu, is a newcomer gaining significant traction. A local branch of a successful Czech business, Kilfi implemented similar safety measures as its parent in the Czech Republic. There is a limit on some items per purchase and delivery to quarantined people is possible, says General Direct James McQuillan in an open letter. Kilfi’s blog focuses on how-to’s such as the right way to store your food.

More than 300% increase across segments and logistics troubles

Other big online stores and marketplaces on the Hungarian market introduced similar measures, namely AQUA, OLCSOBBAT.hu, iPon and LibriBookline. “It seems that the waves are hitting Hungary in the same way they have in the Czech Republic or Slovakia during the coronavirus outbreak, economically and socially,” László Szábó, Google Certified Trainer for Export to the Czech Republic and Slovakia, and Co-Founder of Growww Digital sees across the three counties. According to Growww Digital’s data, segments such as Groceries, Sport, Entertainments and Health are booming, reaching a 200–300 % increase. “(Not only) Czech companies such as Mall, Alza, Rohlik / Kilfi are experiencing significant growth.”

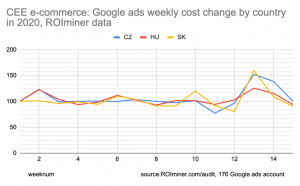

Marketing investments across Hungarian, Czech and Slovakian e-commerce markets

Online retailers exporting to Hungary are therefore not worried about traffic or sales per se, but rather about transportation. “It’s still rather difficult to transport packages through two borders. We’ve seen different ways of handling restrictions at frontiers and closings of border crossings,” László Szábó adds. “Each country has to find balance so the economy as a whole isn’t at risk. This is similar to all countries: they’re aware that it is critical for e-commerce to work.”

Three trends and directions in online retail

Similar to the Czech Republic, online retail in Hungary will grow in demographics that are shopping online for the first time. On the rise are categories that are hard to get at the moment due to closed brick-and-mortar stores, or in segments that people prefer to buy from home due to safety reasons. “Whether these new online shopping demographics return to their old ways or continue shopping online will depend on two factors: what their shopping experience was like and how long the lockdown will last. Three weeks won’t change their habits; two or three months might,” Chief Growth Officer in Dataweps Jenda Perla contemplates. What happens during both Black Friday and the Christmas season will be telling.

Another thing online retailers are expected to do is focus on omnichannel strategy and technologies. Most likely, a part of the population will continue to avoid public places and crowded areas which will result in companies doubling up their investment in online channels, according to research agency IHL Group‘s president Greg Buzek. As home delivery (or work delivery) is very popular among Hungarians already, no radical changes are expected here. As well as in other countries, the population may make cashless payments a habit and will prefer it to cash on delivery from now on.

The third variable is logistics. Hungary is rather decentralized, with significant differences between Budapest and more rural areas. According to Ágnes Janó, Business Consultant at Dataweps, e-commerce authorities advised smaller communities to make their orders together, minimizing the extra load on the sector and shortening the delivery time. The mid- and long-term plans are yet to be revealed. “Growth of e-commerce will likely depend on how carriers and other logistics players respond. For instance, the more new pick-up points outside of Budapest there are, the more people will buy beyond the capital,” her colleague Ivan Rédey sums up. “People’s behavior and willingness to visit public spaces can be shaped by development in e-commerce and logistics. Fast and bold steps may change things significantly.”

Expanding to Hungary is still a viable option. Innovative companies will win

One or two months’ development doesn’t provide enough data to draw conclusions about the future of Hungarian e-commerce. One thing is certain, though: online retailers who are able to pivot, react or think outside the box despite the coronavirus outbreak are gaining momentum – and will win in the future. “Timing worked in favour of Rohlik / Kilfi. The Czech grocery delivery company was just testing Hungary at the end of last year–and look at them now, hiring drivers in bulk only half a year later, something their biggest competitor was able to do after 3-4 years of functioning,” Ivan Rédey reflects.

Similarly to the Czech Republic and Slovakia, pandemics present a great opportunity to Hungary’s e-commerce. Up until now, the market was growing by 20% and attracted a lot of non-Hungarian companies as a number one or two expansion destination. According to estimates of Expandeco – a guide for online stores to drive their businesses beyond borders – more than 2000 Czech online stores have expanded to Hungary (in the sense that they have at least a Hungarian version and/or ship parcels on a monthly basis). “For Czech online stores, Hungary is the place to go, together with Germany and Poland. The majority of our clients have expanded there; we are currently operating 50 online stores,” Expandeco’s CEO Tomáš Vrtík says.

The current situation influenced by coronavirus doesn’t prevent e-commerce businesses from expanding to Hungary. Quite the opposite: it is a chance to succeed for those who challenge the status quo, can adapt and move quickly, and use intelligent, modern technologies.