Czech e-commerce and coronavirus: Record-breaking sales, growing marketplaces and consolidation as well as an emergency mode.

With the exception of grocery shops, pharmacies, drugstores, gas stations, and a few others, retailers have had to close their physical shops nationwide. It naturally follows, with government regulations making it nearly impossible to do any physical shopping in the Czech Republic and people often choosing not to in the first place, that online shopping would flourish. Is that the case, though? What have Czechs started buying in online stores? And how does this emergency situation affect individual segments? What are the scenarios for the coming months? And what can be done about it?

(Some) online stores in full swing

Current restrictions have prompted most Czechs to do their buying online. Some online stores, apps, as well as delivery services for food and other products have seen a spike in orders. Despite that, the crisis will negatively affect some of the online shopping segments as well. “At the moment, our data shows no slump in Czech e-commerce as a whole,” says our CEO, Honza Mayer. “During the first days of the government’s implemented safety measures, some online stores even showed numbers up to 70% higher than those from this time last year,” adds our Chief Growth Officer, Jenda Perla. They both agree that there are huge differences among individual online stores, both in size and segment. For example, Alza.cz reports an increase in sales by tens of percent, and even hundreds of percent with some items (sewing machines, home bakeries). “In the online shopping segment, we are seeing a growth in tens of percent in comparison with last year,” says Radim Roženek, head of online shopping at Tescoma. And he believes that “once the situation stabilizes, there’ll be a great opportunity to grow”.

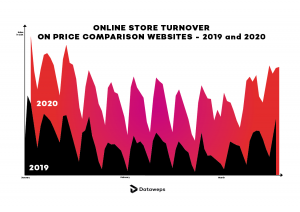

We’ve looked at whether the current situation has affected sales of online stores through product comparison websites. So far, the aggregated data provided by our customers shows a trend more or less the same as in this period last year. Of course, total sales are higher, but a gradual fall in sales in January, lower sales in February, and a gradual start in March were reported by product comparison websites last year as well.

The graph for 2020, however, shows an interesting thing: on the weekend of February 29 and March 1, the usual slump in weekend sales was substantially less pronounced, and on Saturday some online stores reported even higher sales than on Friday, which is unusual. This was the weekend when the first infected people were confirmed in the Czech Republic.

What’s the reaction of online retailers?

Zásilkovna continues working. “The ban on retail sales doesn’t apply to picking up deliveries from online stores, which also takes place in physical shops that are not allowed to sell any other goods, with the exception of those located in malls. This offsets at least some lost profits,” explains ČT 24. “Most of our pick-up points are open. Our logistics works as usual, delivering to the pick-up points as well as to people’s homes. We wear gloves, use disinfectants, and protective foils have been installed in our depots. We’ve banned cash payments at all the pick-up points and allow only non-cash payment. Also, we’ve introduced a number of supporting measures, such as a voicebot on our customer service line, a chatbot on our website, a blog publishing all new information, and automatic updates on the availability of our branches,” says Simona Kijonková, CEO at Zásilkovna. Since Saturday, the company has been updating the information on which pick-up points are open.

“The problem is that numerous couriers have troubles with logistics, reduce their capacities, set new limits, increase their delivery time, etc. And that’s one of the reasons we’re working on our own home delivery service to ensure maximum value and comfort. We have to keep reacting to changing conditions. We do our best to react immediately, which is when the huge advantage of the digital character of our company really shines through. Our processes are flexible and digital, we can switch among various settings, regions or even entire countries and couriers. We established an emergency team as early as last Thursday to adjust company processes to reflect the rapid development and measures taken by the governments in various countries,” adds Milan Šmíd, marketing director at Zásilkovna.

In segments such as online pharmacy, glasses and contact lenses, protective medical equipment and drugstores, game consoles and electronics, Zásilkovna has been reporting a growth comparable with the pre-Christmas period. “Apparently, shopping online, which covers the entire e-commerce segment, is driving most of our economy right now, and its role has been growing with every day that physical shops remain closed. This is quite a challenge for a logistics-technology company like us. Today, we represent one of the few paths through which in-demand goods can make it to end customers,” adds Šmíd.

Alza.cz has been adding suppliers affected by this ban into its dropshipment system in an accelerated mode, allowing them to offer their products via Alza.cz within just days. Alza told Dataweps that dozens of retailers have shown interest in dropshipment. The Chinese giant Alibaba has come up with a similar service, Alibaba Cloud, where retailers hit by the crisis can start selling within just five days. “This situation may speed up the growth of marketplaces in Czech e-commerce. If these measures remain in place for long, the livelihood of small players in some segments may become very much endangered, and the option to use the power of a big player via dropshipment and enter the marketplace may be just the help they need,” comments Jenda Perla on behalf of Dataweps.

Concerning sales, equipment for working from home, drugstore products, sports, toys, hobby, and books have been selling very well on Alza. “There has been a year-on-year growth of around 200%. In last seven days, the company has delivered over 100 thousand drugstore and pet products. And another 100 thousand of these products have been prepared directly at branches for immediate pick-up. Also, we’ve been working on an option to offer a product for quick virus testing at home,” says Alza on its blog.

Košík.cz has taken the strictest measures in company history. On its website, it explains the procedure for handing over deliveries, the requirement for non-cash payments and the hygiene of its employees. Its press secretary, František Brož, said in Seznam Zprávy that, in addition to its record-breaking sales, the company has experienced record-breaking expenses on hygienic and safety measures. “Contactless temperature measuring, frequent disinfection of cars, personal disinfection for the delivery team and respirator purchases.”

Heureka.cz has opened a coronavirus section containing the most frequently ordered products during the period of emergency. Here, customers will find everything from freezers to dog food or laptops.

Mall.cz has offered its technology as well as production and broadcasting capacities for live broadcasts of concerts and theatre performances cancelled due to coronavirus. Mall.TV is broadcasting live events such as slam poetry, concerts of famous Czech bands like Zrní, theatre performances of Divadlo na Zábradlí or Cirk La Putyka, lectures of the Centre of Architecture and Metropolitan Planning (CAMP), stand-up shows by Iva Pazderková, and more. Concerning its offer, Mall.cz has created a special section for protection against the flu and similar diseases, containing vitamins, disinfectant soaps, air purifiers, filter kettles, respirators, etc. However, some products have already sold out. Also, the shop reports 300 times higher demand for baby food and a record-breaking increase in the sales of sewing machines. According to iRozhlas, “the online store sold 118 sewing machines in a single day, which is what it usually sells in an entire week”.

Rohlík.cz has taken measures similar to Košík. Its website has been slow and customers have to wait in virtual line. Among other things, the changes affect the size of the order. Just like Košík.cz, which raised the minimum order to 800 CZK due to a lack of drivers, Rohlík.cz introduced the limit of 50 kilograms per delivery to prevent people from panic-buying all of its goods. On his LinkedIn profile, Tomáš Čupr apologized for not being able to stick to the delivery time within several hours. Just like restaurants, Rohlík.cz has been cooperating with companies such as Dodo (currently asking its volunteers to help deliver food and medicine for seniors and at-risk groups).

In terms of logistics, various safety measures have been taken (hygiene, contactless payments, cancelling COD and returning products that we ordered COD). There have been troubles with delayed deliveries mainly due to the situation at the Polish border and a potential change of options concerning delivery methods has been discussed. This is the experience of Alensa.cz, an online store selling contact lenses: “The pick-up points are updated every single hour, as the situation has been changing quickly. They can be closed any time and our packages could be going to a pick-up point which is already closed,” says Jan Jelínek, online marketing manager. And he adds that some countries have been delivering exclusively to pick-up boxes only, for example the Baltic States.

Important: The situation has been changing quickly, so all the predictions are only assumptions. Current information is published for example by the Ministry of Health and you can also follow retailer websites.

Online retail will swell with new customers

When planning, our CEO, Honza Mayer, recommends first separating short-term and long-term visions. “In terms of short-term planning, there’ll certainly be categories that show rapid growth based on current demand and the mass hysteria instigated by the media,” he explains. Spokojený pes, a retailer for pet products, has a similar opinion: “I wouldn’t like to talk about growing sales now, as I’d prefer our usual sales to the current situation. Nevertheless, since the end of February we’ve been selling around 100 to 150% more food, treats, and toys than what’s usual for this period,” says marketing manager, Tomáš Haškovec. The peak came on Thursday, March 12, when daily sales reached almost 3 million CZK. The online store was able to handle this onrush thanks to the extraordinary efforts of warehouse personnel and without having to substantially extend its delivery times. Since then, the situation has been gradually returning to normal.

This is something a lot of haberdasheries would confirm. According to iRozhlas, Stoklasa shop reports three times more orders placed by those who sew face masks at home. And Alensa.cz, which sells contact lenses and glasses, has been reporting increased orders as well. “We’ve been seeing growth across markets, in some countries up to 40% in comparison with last week. Spain is an exception, as lots of people are isolated there. There are two types of shopping behaviour. In countries with a lower level of restrictions, people – mostly our permanent customers – are stocking up. In countries with tougher restrictions or quarantine, customers move from physical shops to our online store. These people often have no other choice and are surprised to learn that we can grind and deliver dioptric glasses for them. In Italy, which has been in quarantine for some time now, there’s been a growth of 71% when compared to three weeks ago. And we expect similar development in other countries as well,” says Jan Jelínek, after analysing the data.

In general, online retail will grow either in the categories of products that cannot be purchased elsewhere, as physical shops are closed, or in segments people prefer ordering from home for safety reasons. “Here, it all depends on what the people’s experience will be and on how long the emergency situation remains in place. Two weeks isn’t enough for people to get used to buying online, while two months may be enough time to make it automatic for some of them,” says Jenda Perla on possible purchasing trends.

It’s much harder to make a long-term prediction, as we don’t know how long the current measures will stay in effect. Since the measures were taken by the government, Czechs have behaved more or less responsibly. The question is, however, how the government and our society will deal with the return of our citizens now remaining in countries such as Germany, the UK, or Austria. From among the people who returned from Italy at the beginning of this crisis, almost half (46%) breached the compulsory quarantine at least once during the first week. “Things may return to normal relatively quickly or the crisis may take longer, which would result in a slump for not only physical but also online retail shops,” sums up Honza Mayer. The key question is how long this interim period will be.

Short-term growth for household products, fashion falling

Situation advantageous for big players

The advantage of big players are their strong, stable brands that people trust. “Big players with a wide portfolio or operating in segments where people are currently doing massive amounts of shopping will profit from this situation. However, small players, even those operating in growing segments, may be destroyed by the current situation,” says Jenda Perla. Adam Kurzok, founder of Expando, is another who sees every day that this situation is advantageous for the giants. “In every crisis, people become less willing to take risks and prefer to trust big brands. This is why Mall and Alza here, and Amazon in Western Europe, have been growing rapidly. And I think this trend will continue; depending on how long this virus crisis takes, some online stores may go bankrupt, which will make consumers even more careful. The big ones will profit from this shock.”

Another thing widening the gap between the large and the small is storage, as the big players have sufficient supplies. “On the other hand, online stores with no supplies that were used to selling goods without actually having it in stock will find it extremely difficult to stock up and get the goods to their customers. Besides, half the goods come from China which imposed an embargo on export,” comments Jenda Perla. At the same time, according to the boss of Expando, the closed borders will make big online stores switch to marketplaces more quickly, as they won’t lose money on the goods they don’t have in stock during the quarantine.

Distributors may find this situation a bit difficult as the number of potential customers drops and they become more dependent on several huge players.

In the long run, COVID-19 will speed up the development e-commerce has been expecting: consolidation, growth of marketplaces, and dominance of big players

- In the long run, the crisis will show who was prepared for the growth of online shopping. Right now, everybody is buying online, but the question is whether they remain online even after the current measures are lifted.

- The current situation may have an educational and even healing effect on some parts of business.

- This is a ripe time for innovations, as well as orienting on customers and satisfying their needs.

- The popularity of the omnichannel among retailers will grow, i.e. to have other channels, such as marketplaces, in addition to their physical and online stores. Also, dropshipment by Alza or Alibaba Cloud confirm the switch to marketplaces.

- Logistics is going to dynamically change and a switch to home deliveries is expected. Depending on how long the restrictive measures remain in place, some people living in cities may get used to deliveries. The question is how retailers will manage to deliver to towns and villages.

- Hybrid models of production will grow, as they don’t depend on supplies (i.e. printed and produced only after being ordered, typical of glasses and wall stickers).

- People will get even more used to having their lives connected with the online environment in a number of ways. Onlife thus becomes a reality, even though we don’t communicate in virtual reality yet.